Credit Card Balance Data#

A simulated data set containing information on 400 customers.

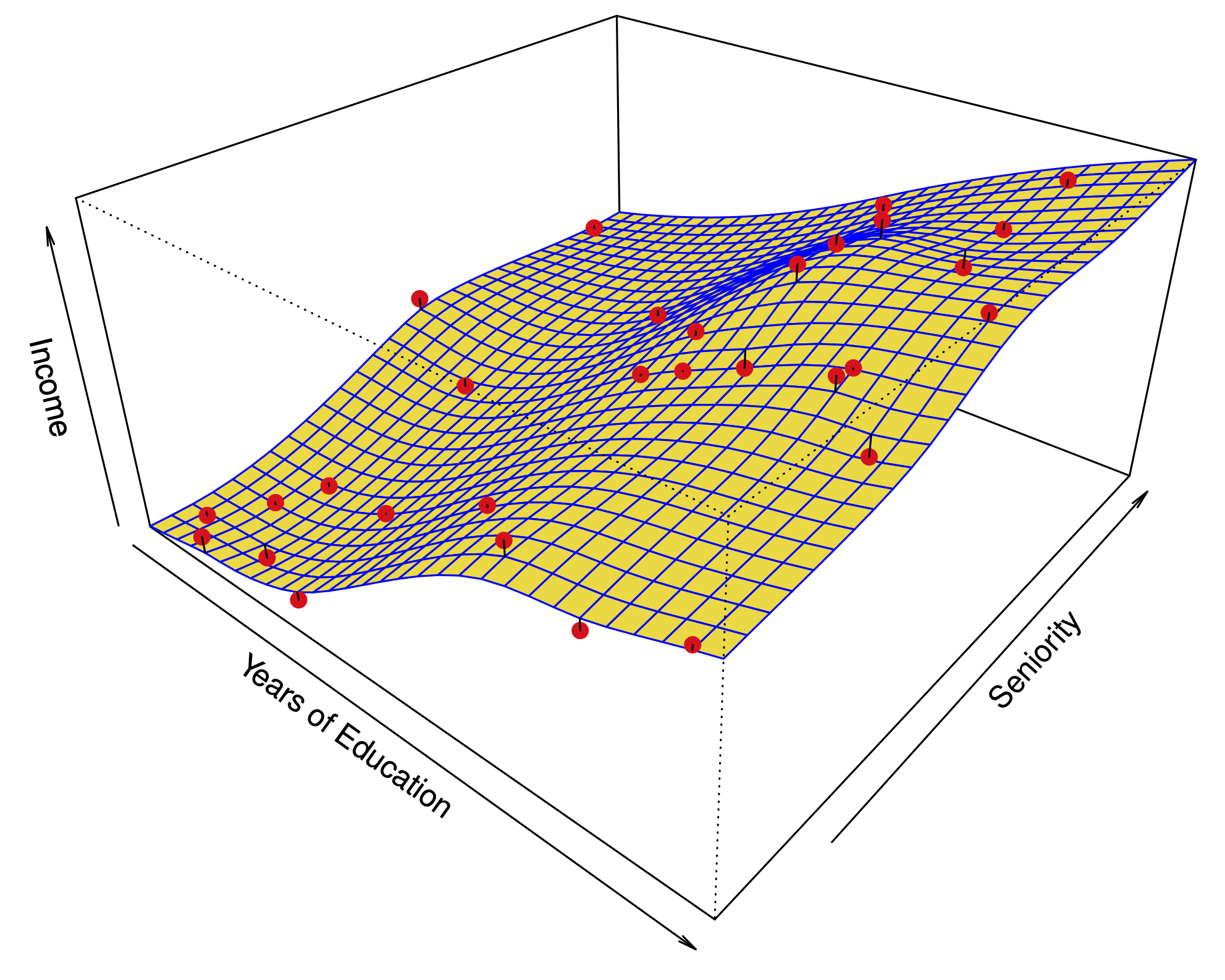

Income: Income in $1,000’sLimit: Credit limitRating: Credit ratingCards: Number of credit cardsAge: Age in yearsEducation: Education in yearsOwn: A factor with levels No and Yes indicating whether the individual owns a homeStudent: A factor with levels No and Yes indicating whether the individual is a studentMarried: A factor with levels No and Yes indicating whether the individual is marriedRegion: A factor with levels East, South, and West indicating the individual’s geographical locationBalance: Average credit card balance in $

Source#

Simulated data. Many thanks to Albert Kim for helpful suggestions, and for supplying a draft of the man documentation page on Oct 19, 2017.

from ISLP import load_data

Credit = load_data('Credit')

Credit.columns

Index(['ID', 'Income', 'Limit', 'Rating', 'Cards', 'Age', 'Education',

'Gender', 'Student', 'Married', 'Ethnicity', 'Balance'],

dtype='object')

Credit.shape

(400, 12)

Credit.columns

Index(['ID', 'Income', 'Limit', 'Rating', 'Cards', 'Age', 'Education',

'Gender', 'Student', 'Married', 'Ethnicity', 'Balance'],

dtype='object')

Credit.describe().iloc[:,:4]

| ID | Income | Limit | Rating | |

|---|---|---|---|---|

| count | 400.000000 | 400.000000 | 400.000000 | 400.000000 |

| mean | 200.500000 | 45.218885 | 4735.600000 | 354.940000 |

| std | 115.614301 | 35.244273 | 2308.198848 | 154.724143 |

| min | 1.000000 | 10.354000 | 855.000000 | 93.000000 |

| 25% | 100.750000 | 21.007250 | 3088.000000 | 247.250000 |

| 50% | 200.500000 | 33.115500 | 4622.500000 | 344.000000 |

| 75% | 300.250000 | 57.470750 | 5872.750000 | 437.250000 |

| max | 400.000000 | 186.634000 | 13913.000000 | 982.000000 |